Insights into ESG Topic Trends in the Korean Capital Market

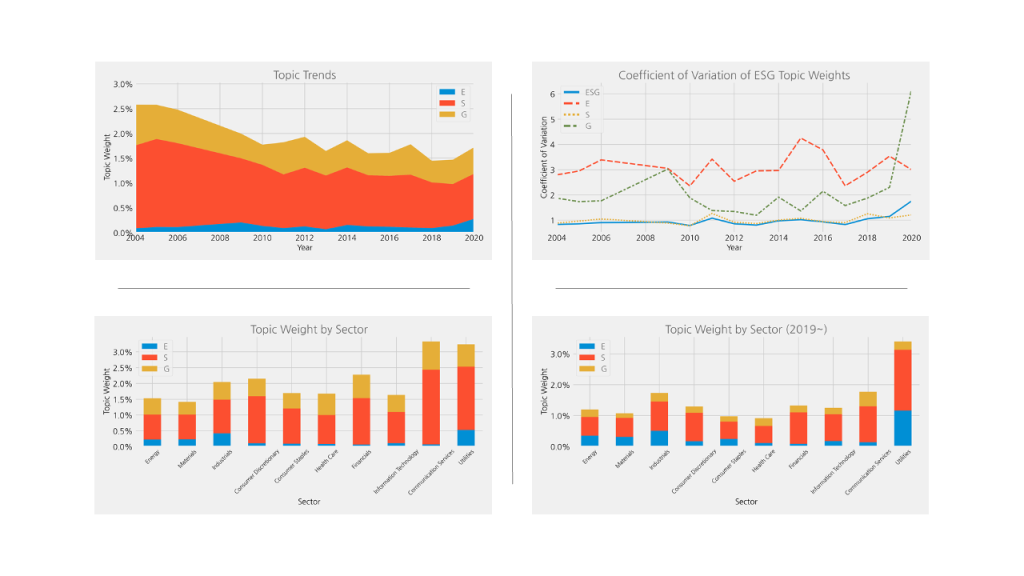

In the ever-evolving landscape of the Korean capital market, a fascinating trend has emerged in the realm of Environmental, Social, and Governance (ESG) investing. As I delved into the analyst research reports, it became apparent that ESG topics are gaining significant traction, now accounting for an average of about 2 percent of the content.

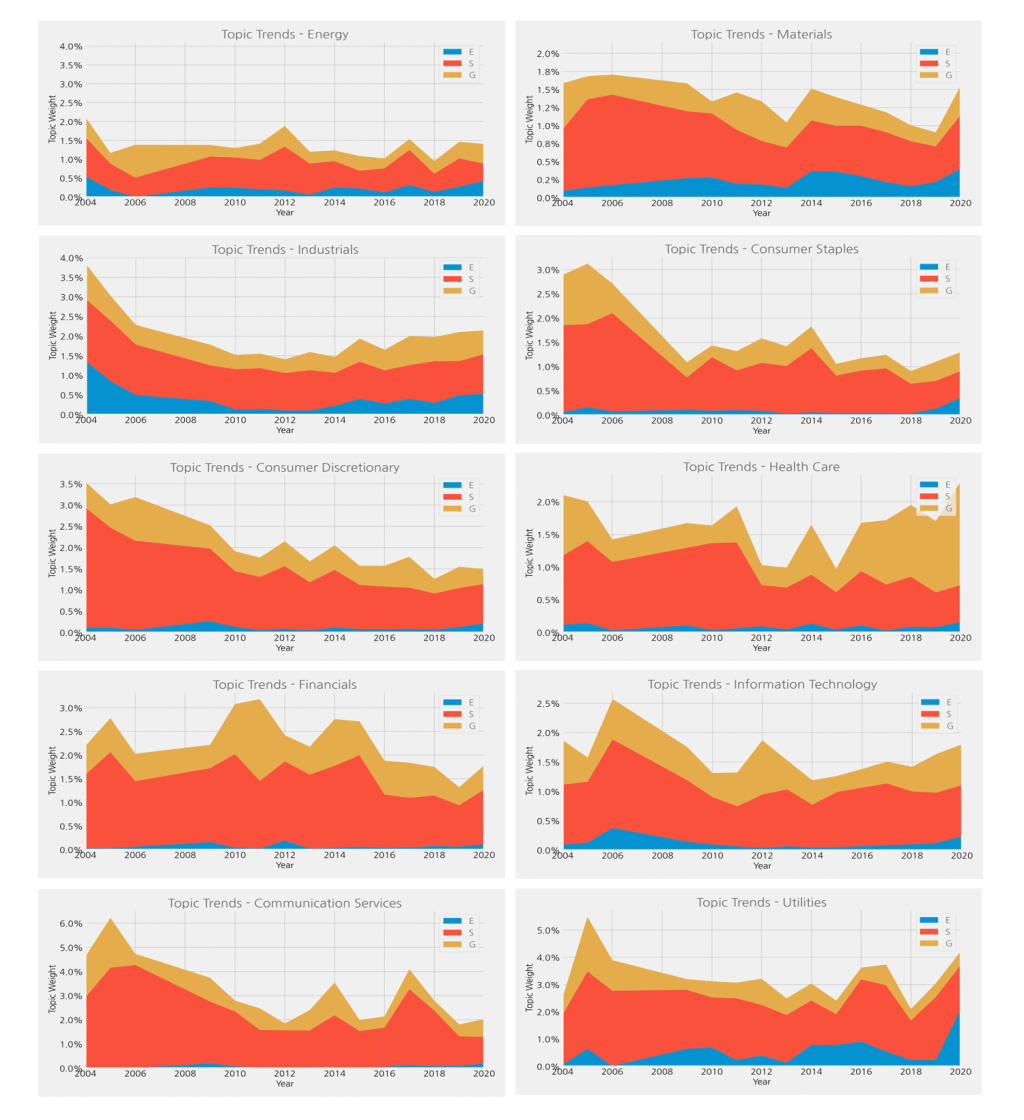

A closer analysis revealed an intriguing pattern: the Social aspect, encompassing Corporate Social Responsibility (CSR) issues, dominates the ESG discussion, taking up the largest proportion among the ESG themes. This prominence of Social factors in ESG analysis reflects the growing importance of corporate responsibility in the eyes of investors and analysts alike.

Interestingly, though the Environmental topic represents the smallest share, it exhibits the greatest variability. This is a noteworthy development, especially considering the recent uptick in the proportion of environmental discussions. It signals a rising awareness and concern about environmental issues within the Korean capital market.

What’s more, a sector-by-sector comparison of the topic weights uncovers significant variations. This diversity highlights how different industries prioritize and approach ESG issues, underlining the nuanced nature of ESG considerations across the market.

These evolving trends in ESG topic coverage – from the increasing emphasis on environmental issues to the varied sectoral approaches – paint a dynamic picture of the Korean capital market’s engagement with ESG. It’s a landscape that is not just about lumping ESG together, but about understanding the distinct narratives and impacts of each element – Environmental, Social, and Governance – on firm valuations, risk-return profiles, and overall market perceptions.

As we continue to navigate this complex yet crucial field, the shifts in ESG topic coverage will undoubtedly tell us more compelling stories about the market’s direction and priorities.