Unraveling the ESG Narrative in the Korean Capital Market

As we witness an unprecedented surge in ESG investing, I find it fascinating to delve into how this trend is unfolding in the Korean capital market, particularly through the lens of analyst research reports.

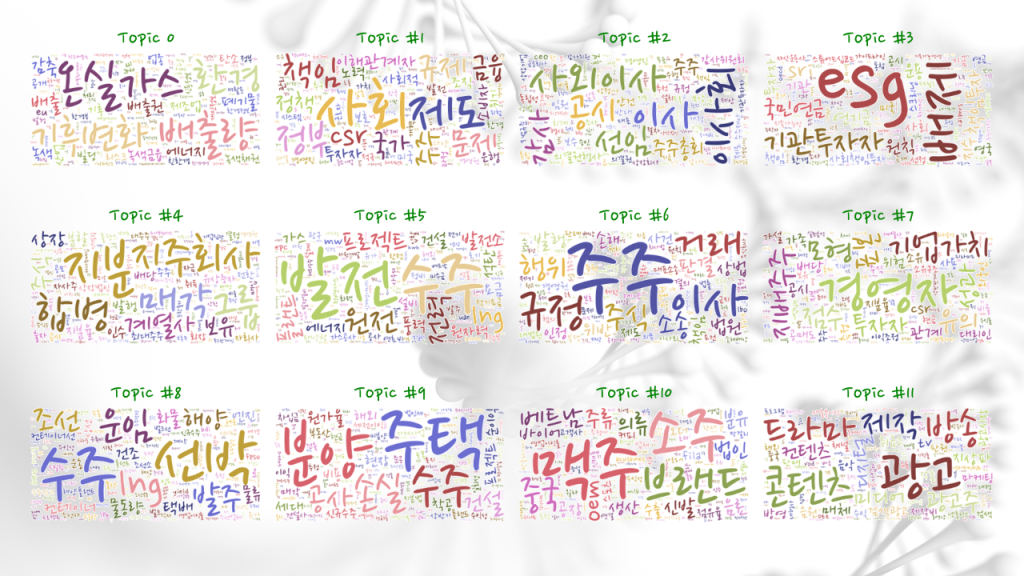

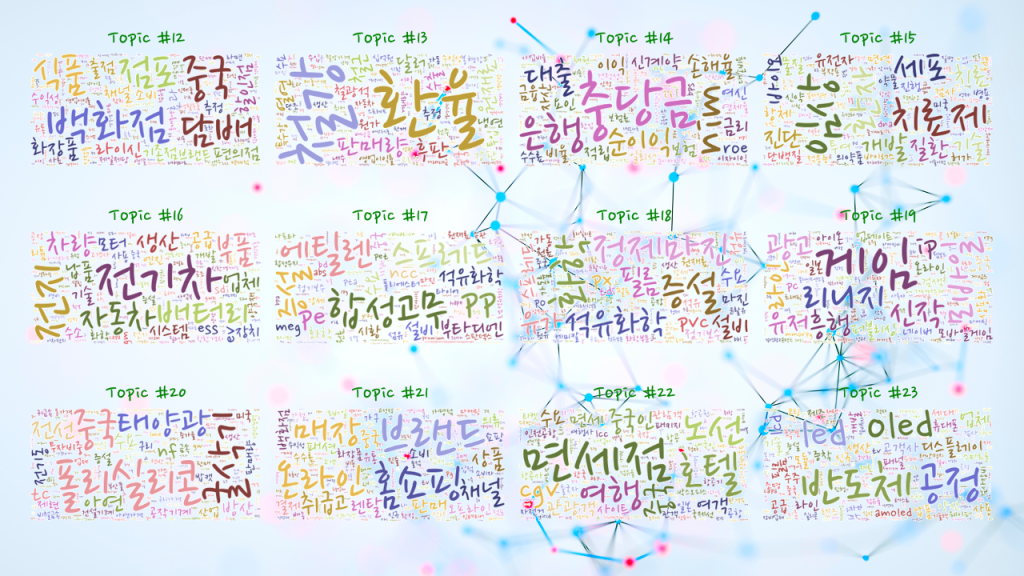

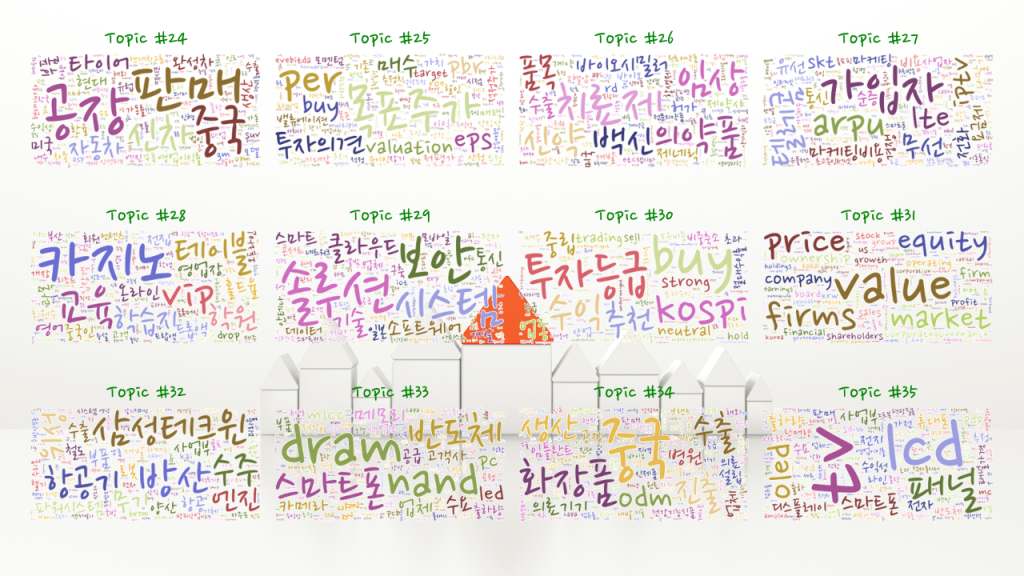

The cover image of my latest analysis vividly captures four out of thirty-six ESG topics, beautifully representing each of the three main ESG areas – Environmental, Social, Governance – along with the overarching theme of ESG investment. This image serves as a gateway to understanding the nuanced and distinct nature of each ESG issue, moving beyond the traditional practice of lumping them together.

The journey of ESG in the Korean capital market is a story of evolving trends and shifting importance. As an analyst, I find it intriguing to analyze the changing proportions and compositions of these ESG topics. They’re not just topics; they’re narratives that reveal deeper insights about risk-return profiles, their impact on firm valuation, and much more.

In my ongoing analysis, I aim to uncover these hidden stories – to understand how each ESG aspect uniquely contributes to the broader investment landscape. This exploration is not just about numbers and trends; it’s about how environmental responsibility, social impact, and governance practices are reshaping the corporate world and investment decisions.

Join me in this analytical journey as we uncover more about the ESG narrative in the Korean capital market. The findings promise to offer valuable perspectives on how ESG factors are becoming integral to investment strategies and corporate evaluations. Let’s dive deeper into this evolving ESG landscape and discover the stories they tell.